As middle-class incomes stagnate in advanced economies while the rich experience record income gains, the eleventh semi-annual Munk Debate pits wealth redistribution supporters Paul Krugman and George Papandreou against Newt Gingrich and Arthur Laffer to debate taxation — should the rich pay more?

For some the answer is obvious: redistribute the wealth of the top income earners who have enjoyed, for almost a generation, the lion’s share of all income gains. Imposing higher taxes on the wealthy is the best way for countries such as Canada to reinvest in their social safety nets, education, and infrastructure while protecting the middle class. Others argue that anemic economic growth, not income inequality, is the real problem facing advanced countries. In a globalized economy, raising taxes on society’s wealth creators leads to capital flight, falling government revenues, and less money for the poor. These same voices contend that lowering taxes on everyone stimulates innovation and investment, fuelling future prosperity.

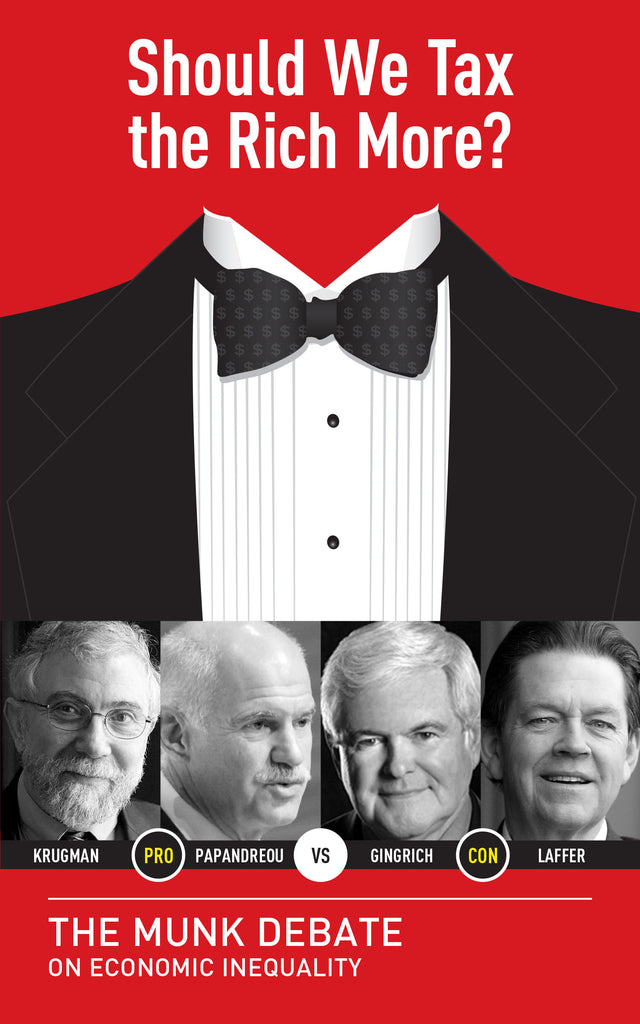

In this edition of the Munk Debates — Canada’s premier international debate series — Nobel Prize–winning economist Paul Krugman and former Prime Minster of Greece George Papandreou square off against former Speaker of the U.S. House of Representatives Newt Gingrich and famed economist Arthur Laffer to debate if the rich should bear the brunt of higher taxes.

For the first time ever, this stimulating debate, which will take place in front of a sold-out audience, will be available in print. With advanced countries facing overextended social services, crumbling infrastructure, and sluggish economic growth, the Munk Debate on economic inequality tackles the essential public policy issue: Should we tax the rich more?

As middle-class incomes stagnate in advanced economies while the rich experience record income gains, the eleventh semi-annual Munk Debate pits wealth redistribution supporters Paul Krugman and George Papandreou against Newt Gingrich and Arthur Laffer to debate taxation — should the rich pay more?

For some the answer is obvious: redistribute the wealth of the top income earners who have enjoyed, for almost a generation, the lion’s share of all income gains. Imposing higher taxes on the wealthy is the best way for countries such as Canada to reinvest in their social safety nets, education, and infrastructure while protecting the middle class. Others argue that anemic economic growth, not income inequality, is the real problem facing advanced countries. In a globalized economy, raising taxes on society’s wealth creators leads to capital flight, falling government revenues, and less money for the poor. These same voices contend that lowering taxes on everyone stimulates innovation and investment, fuelling future prosperity.

In this edition of the Munk Debates — Canada’s premier international debate series — Nobel Prize–winning economist Paul Krugman and former Prime Minster of Greece George Papandreou square off against former Speaker of the U.S. House of Representatives Newt Gingrich and famed economist Arthur Laffer to debate if the rich should bear the brunt of higher taxes.

For the first time ever, this stimulating debate, which will take place in front of a sold-out audience, will be available in print. With advanced countries facing overextended social services, crumbling infrastructure, and sluggish economic growth, the Munk Debate on economic inequality tackles the essential public policy issue: Should we tax the rich more?

| Published By | House of Anansi Press Inc — Nov 2, 2013 |

| Specifications | 128 pages | 5 in x 8 in |

| Keywords | Social Services & Welfare; Economic Conditions; Economic Policy; |

|

Supporting Resources

(select item to download) |

Excerpt |

| Written By | George Papandreou was the prime minister of Greece from 2009 to 2011. He is the current president of the Socialist International. |

| Written By | Newt Gingrich is the former speaker of the U.S. House of Representatives, a New York Times bestselling author, and Time magazine’s 1995 Man of the Year. |

| Written By | Arthur Laffer is known as the "father" of supply-side economics. He was also economic adviser to Ronald Reagan for both of his terms, a member of the Reagan-Bush Finance Committee, and adviser to Margaret Thatcher on fiscal policy. |

| Written By | Paul Krugman is an American economist, Professor of Economics and International Affairs at Princeton, Centenary Professor at the London School of Economics, and columnist for the New York Times. He won the Nobel Prize in 2008. |

| Written By |

| George Papandreou was the prime minister of Greece from 2009 to 2011. He is the current president of the Socialist International. |

| Written By |

| Newt Gingrich is the former speaker of the U.S. House of Representatives, a New York Times bestselling author, and Time magazine’s 1995 Man of the Year. |

| Written By |

| Arthur Laffer is known as the "father" of supply-side economics. He was also economic adviser to Ronald Reagan for both of his terms, a member of the Reagan-Bush Finance Committee, and adviser to Margaret Thatcher on fiscal policy. |

| Written By |

| Paul Krugman is an American economist, Professor of Economics and International Affairs at Princeton, Centenary Professor at the London School of Economics, and columnist for the New York Times. He won the Nobel Prize in 2008. |